In recent times we have been faced with many emotional highs and lows that test investor behaviour and discipline as markets experience volatility. For everyone, there is a natural reaction to feel a ‘Fear Of Missing Out’ as markets rise, and the fear of loss as markets fall, a fear that is felt more keenly emotionally than the positive emotions we experience when markets rise.

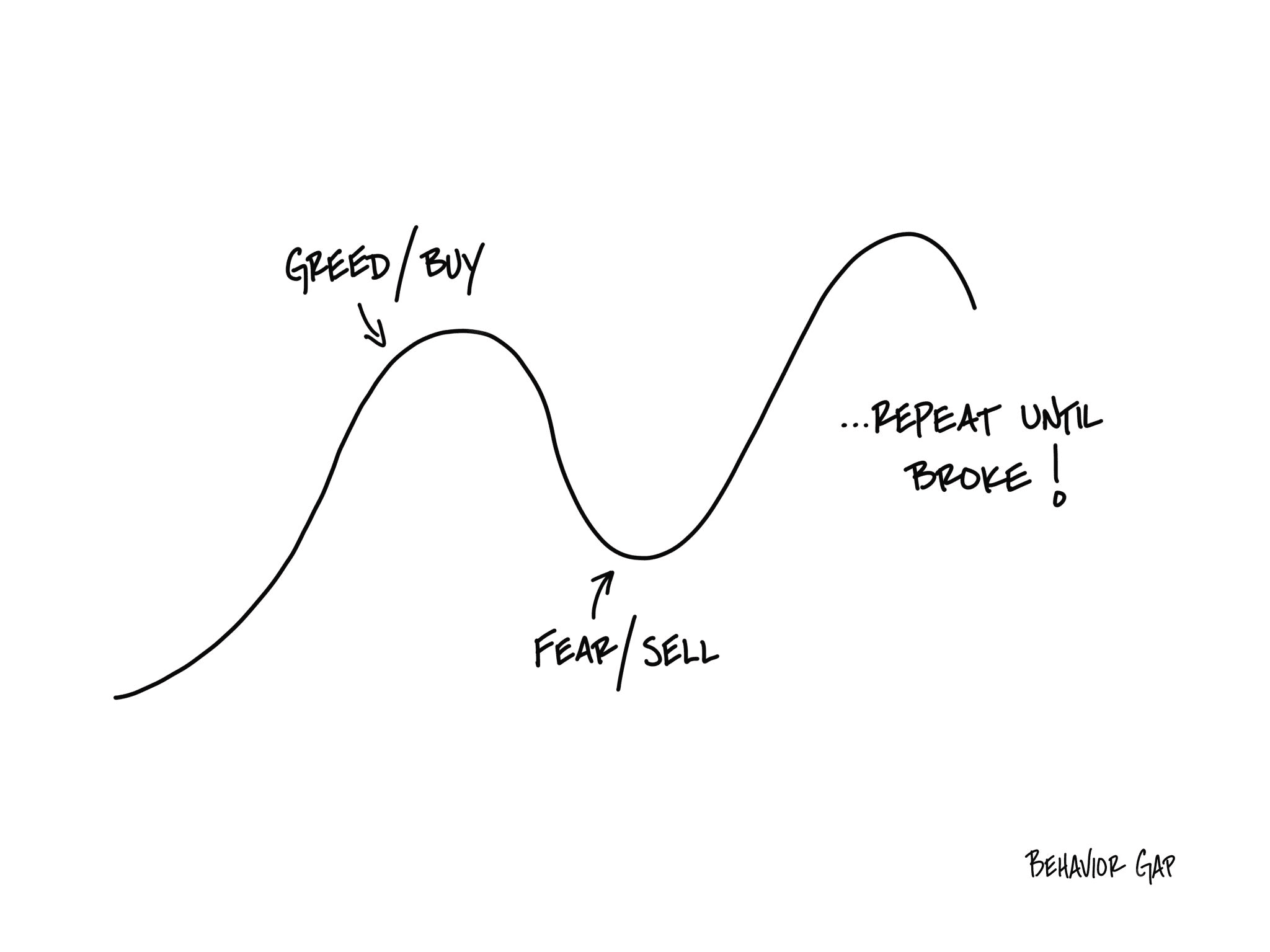

Image Credit: Behavior Gap

The result of acting on these emotions can be buying as markets rise, and selling as markets fall, locking in losses, amplifying the feelings of loss, and for some, permanently changing attitudes to risk.

During these periods of volatility, a financial adviser can help by offering not only their expertise in investments, but equally importantly an objective perspective, evaluating whether any changes are required and helping to maintain the discipline necessary to stay the course for the long term.

If you’d like to discuss your current situation or have any questions please contact us.

The information contained within this website does not consider your personal circumstances and is of a general nature only. You should not act on it without first obtaining professional financial advice specific to your circumstances. Before purchasing any financial product, always consider the relevant Product Disclosure Statement (if applicable) which provides full details of risks, terms and conditions.

Some details (including names) have been modified for privacy purposes and assumptions have been applied regarding future interest rates, investment returns, the client’s circumstances and other financial and economic variables for illustrative purposes – actual outcomes may vary.