Is It Good Or Bad New?

Before we begin this article, it is important to disclose that this article is not intended to discuss political ideology but instead analyse government policies effect on the economy from a purely economic standpoint.

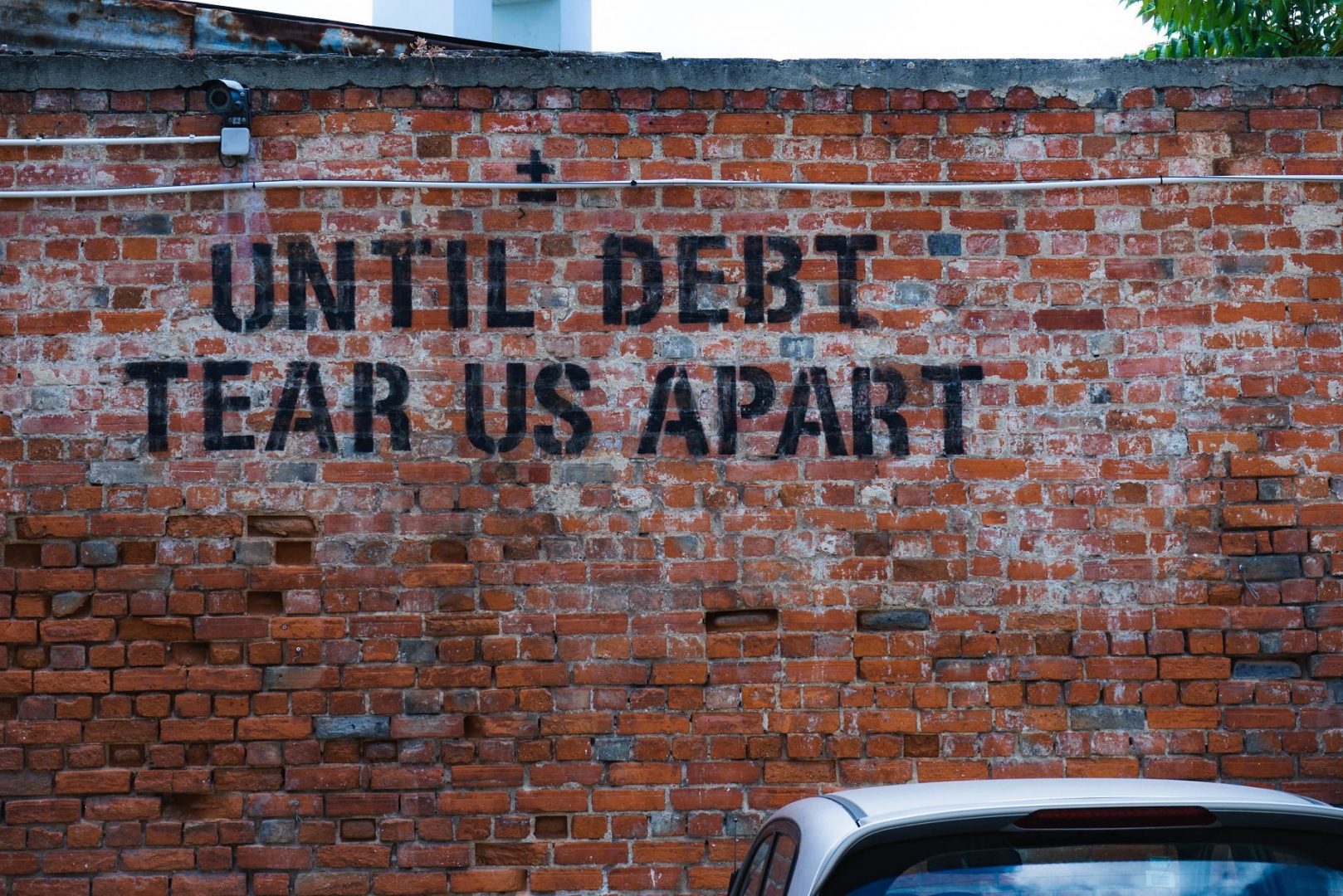

How Big Is The Government's Current Debt?

According to the 2021 budget the current total of government “gross debt is expected to be 40.2 per cent of GDP at 30 June 2021, increasing to 50.0 per cent of GDP by the end of the forward estimates” If you were to compare this debt to historical numbers our debt would seem catastrophic. However, given the world is currently heavily impacted by a global pandemic and other economies around the world are seeing debt to GDP rations much higher than this our domestic debt level by comparison is far less concerning. For example, in the US their debt to GDP ratio is currently sitting at 128% at the time of writing this article. That means right now the US has more debt than their entire yearly productive capacity. This also shows why there is currently worry about the US beginning to print money to cheapen and pay back its debt faster.

By this comparison Australia’s position is far less concerning given our debt is more than a third of that amount and there currently isn’t any indication of the government printing money to reduce the cost of its debt.

How Has This Debt Affected The Economy?

Due to government policy outlined in the 2021 federal budget we as a nation are yet to see any negative effects from this deficit. This is simply because the government hasn’t attempted to recoup this deficit to date and instead has decided to prop up the economy at the cost of running a budget deficit. As a result of this effort to prop up the economy combined with low cases of infection the economy recovered at a rate of 9 months earlier than previously predicted. Now Australian markets are again retuning to all time highs and other countries around the world are applying our approach to the pandemic to try and replicate the results. All while maintaining a low rate of immunization it is clear that the choice to run a budget deficit to prop up the economy has greatly improved Australia’s rate of recovery.

So Is The Current Debt Good Or Bad?

Depending on where you sit on the political spectrum your answer to this question may be different. However, when answered from an economic standpoint this debt is clearly a necessary evil. Leaving the Australian economy to fend for itself during the pandemic could have been extremely damaging to local business and may have caused industries to collapse much further than we witnessed. At the same time blowing out the budget to levels similar to the US could have forced the government into a deficit much harder to recoup and encouraged negative currency devaluation.

As such it is our opinion that the current debt is necessary as there clearly was no simple answer to covid without large amounts of government intervention.

If you’d like to discuss your current situation or have any questions please contact us.

The information contained within this website does not consider your personal circumstances and is of a general nature only. You should not act on it without first obtaining professional financial advice specific to your circumstances. Before purchasing any financial product, always consider the relevant Product Disclosure Statement (if applicable) which provides full details of risks, terms and conditions.

Some details (including names) have been modified for privacy purposes and assumptions have been applied regarding future interest rates, investment returns, the client’s circumstances and other financial and economic variables for illustrative purposes – actual outcomes may vary.